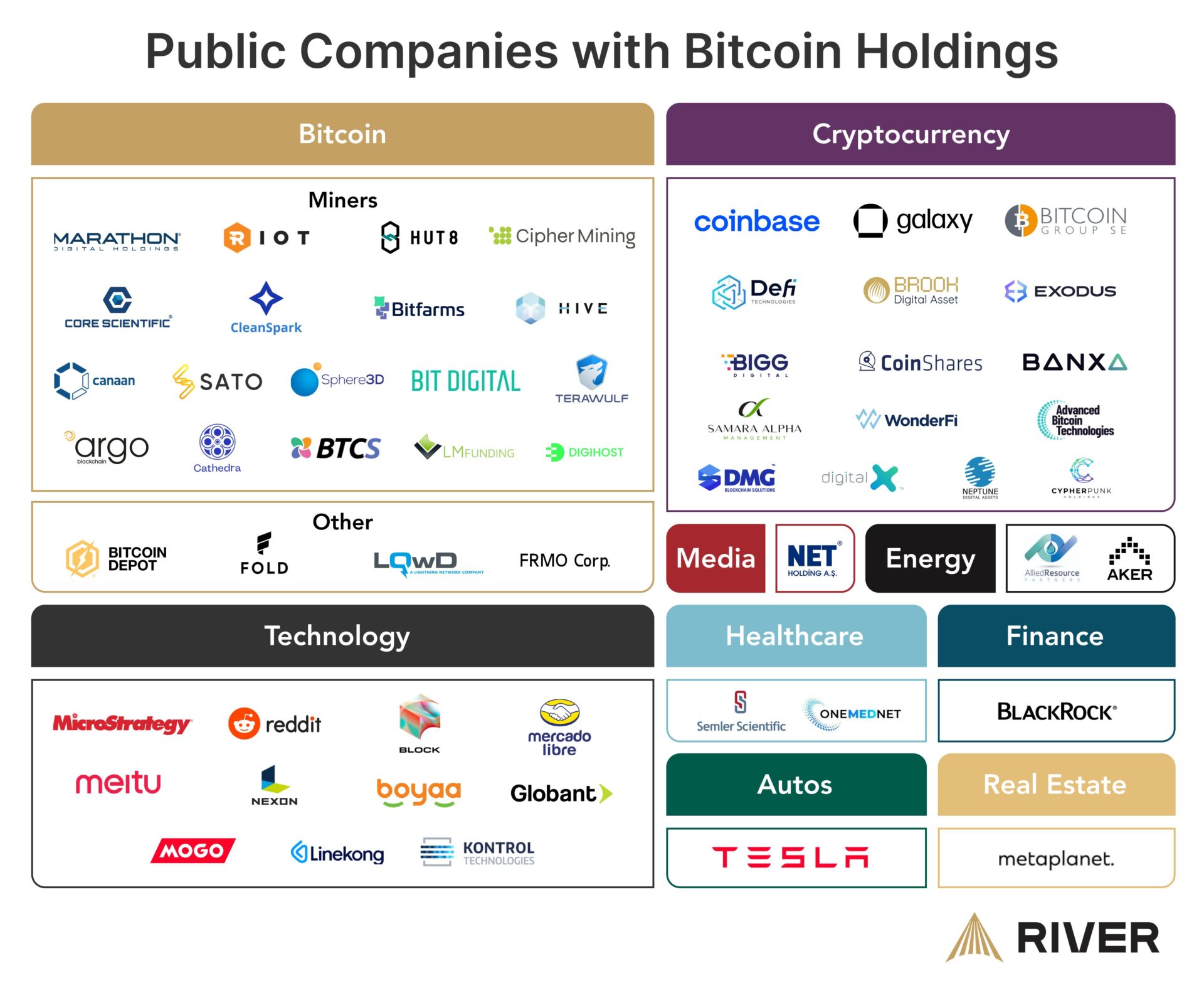

As of November 2024, 62 publicly traded firms have adopted a Bitcoin treasury strategy, according to River, a financial services company that specializes in Bitcoin.

On November 27, mining firm MARA, formerly known as Marathon Digital, provided investors with an update on how it had acquired 6,474 Bitcoin BTC through a recent 0% $1 billion convertible note issuance.

Following the initial acquisition of 5,771 Bitcoin at an average price of $95,395 per coin, the business reportedly bought an additional 703 Bitcoin. MARA has over 34,797 BTC in its treasury, which is worth about $3.3 billion. The company’s BTC yield per share so far this year is 36.7%.

Additionally, MARA paid $200 million for a portion of its 2026 notes. The remaining $160 million from the convertible debt raise will be used to buy more Bitcoin at more favorable prices when the price drops.

The Bitcoin Treasury Play by MicroStrategy

Since 2020, MicroStrategy has been buying Bitcoin. A $3 billion senior convertible note issue with zero percent interest was the company’s most recent debt raising.

The capital raise is a component of the company’s ambitious 21/21 plan, which aims to acquire $42 billion in funds over the next three years in order to bolster its balance sheet and buy more Bitcoin.

The price of MicroStrategy’s shares fell by almost 25% on November 21, 2024, despite the company’s intention to purchase Bitcoin with fiat-denominated debt and increased investor interest in the business.

Between November 18 and 24, the corporation bought almost 55,000 Bitcoin at an average purchase price of about $97,862 per Bitcoin. With around 386,700 BTC in total holdings, MicroStrategy is now among the biggest holders of the virtual currency.

Critics of MicroStrategy, however, contend that using debt financing to purchase Bitcoin is a dangerous and unsustainable tactic, leading some to wonder if MicroStrategy is a bubble.

Although MicroStrategy won’t have to repay the loan until 2028, which should give the business plenty of time to weather any short-term market downturns, the company may run into financial difficulties if the price of Bitcoin drops precipitously.