Intro: The Illusion of Transparency in a Centralized World

In an industry built on the promise of decentralization and financial freedom, the irony couldn’t be sharper — some of the largest crypto exchanges operate with less transparency than traditional banks.

Coinbase, once hailed as the bridge between crypto and regulation, now finds itself facing growing criticism from users who experience delays, silence, and bureaucratic contradictions when trying to withdraw their own money.

One recent case involving Coinbase and WUPD, an institution tasked with verification and fund distribution, lays bare the cracks in Coinbase’s support system — and exposes how “security clearance” can become a tool for indefinite delay.

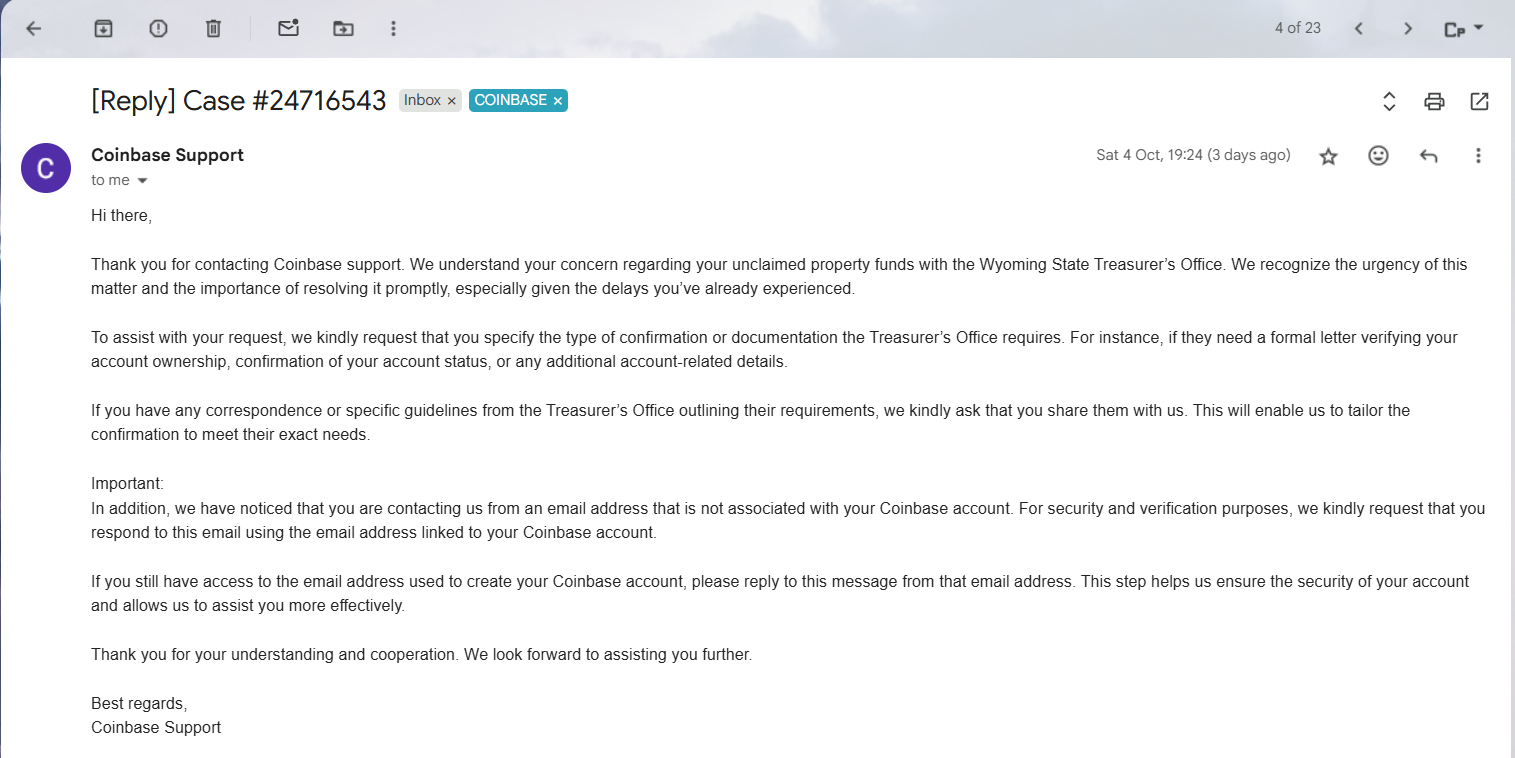

“Contact WUPD” → “We’ve completed our part” → “Awaiting internal security clearance”

These three contradictory statements, all coming from Coinbase’s customer support, perfectly illustrate the confusion and lack of accountability surrounding the case.

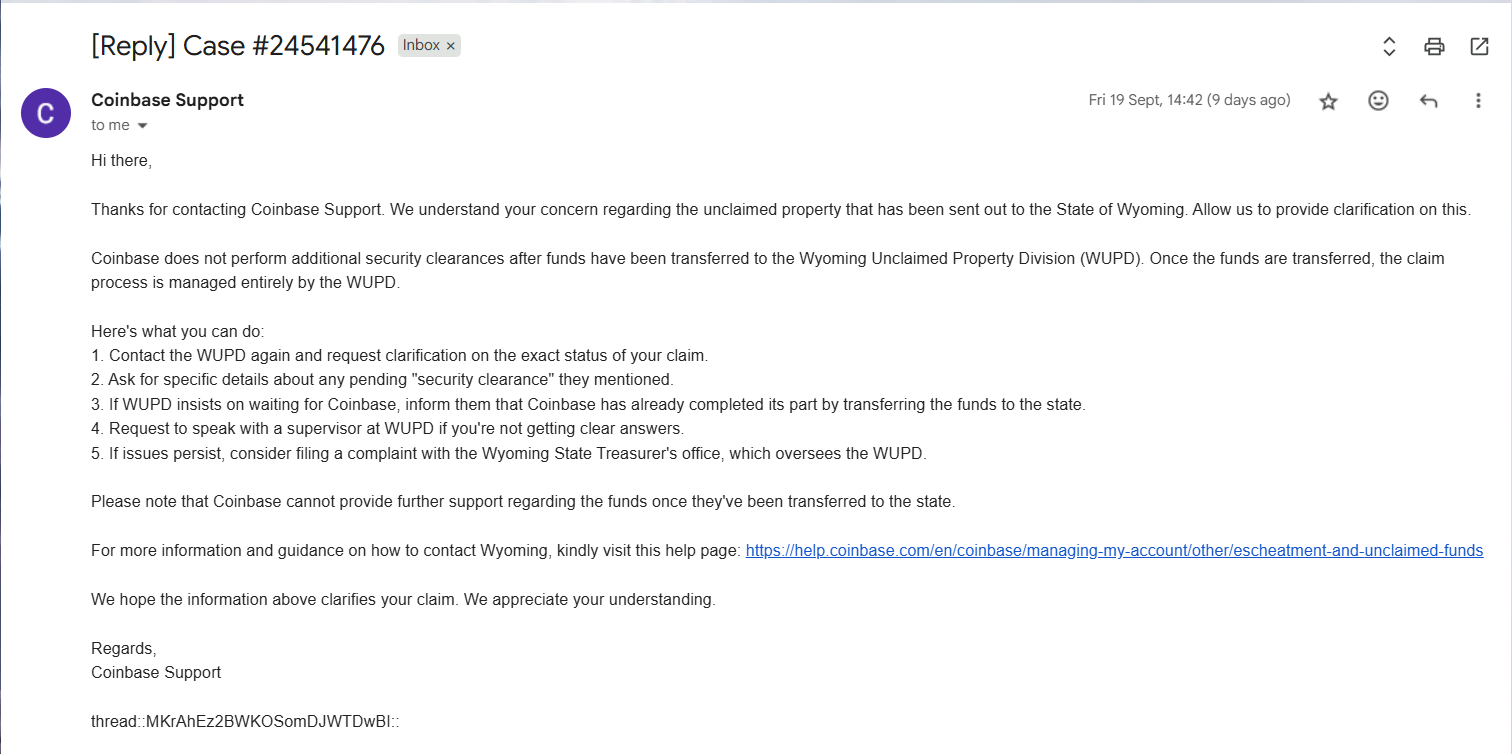

In the first response, Coinbase advised the user to contact WUPD, claiming the process was in their hands.

In the second, Coinbase said they had already completed their part.

And in a third reply, sent days later, they admitted the funds were still under Coinbase’s internal review, waiting for the so-called security clearance before release.

Three different answers. One case. Zero transparency.

Such inconsistency would be unacceptable in a small local service — let alone in one of the world’s largest cryptocurrency exchanges, managing billions of dollars in client funds. The issue here isn’t just procedural; it’s about honesty and accountability. Users deserve clear answers about where their money is, who controls it, and why it’s being delayed.

A Process Without an End — and Answers Without Meaning

Coinbase describes its “security clearance” process as a protective measure for user safety.

In reality, it often becomes a black hole of silence and waiting. These reviews can take weeks, even months, with no way for users to track progress or contact a real person who can explain what’s going on.

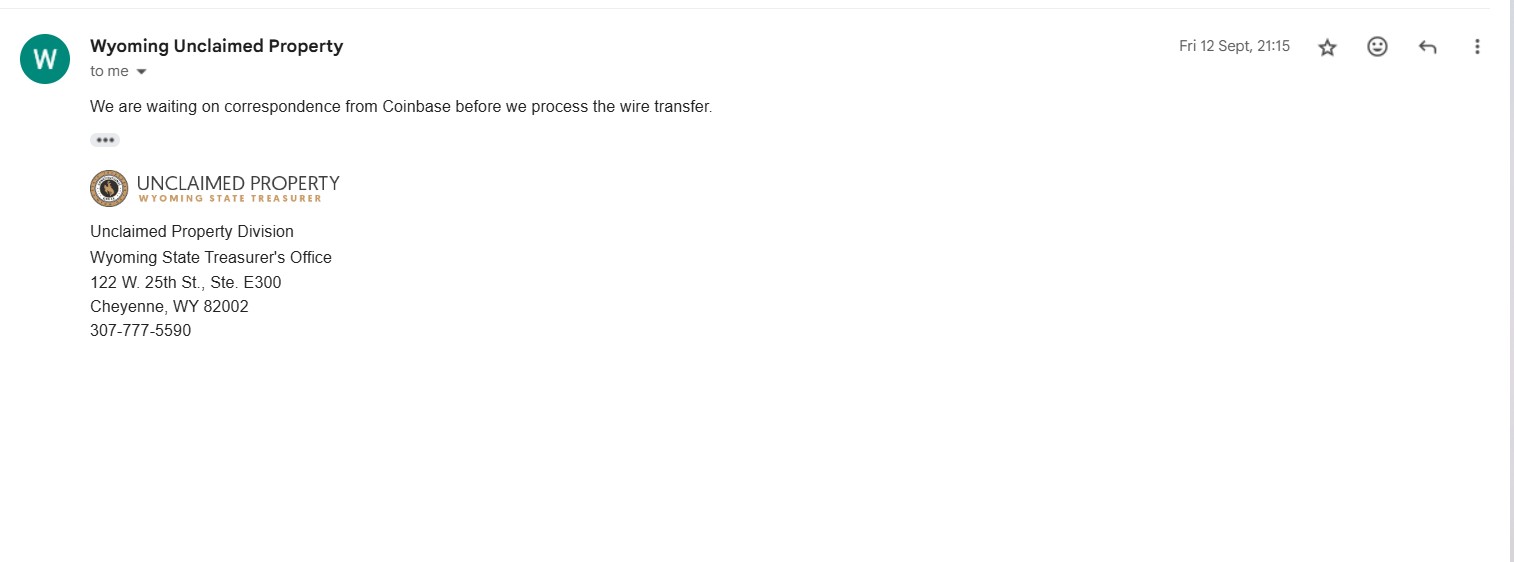

In this particular case, WUPD confirmed more than 20 days ago that all requested documents and verifications had been completed and sent to.

Coinbase. Their message was clear: our part is done; we’re waiting on Coinbase.

Yet Coinbase continued to send conflicting replies, creating the impression that the system is intentionally obscured — a convenient fog designed to delay payouts while avoiding any direct admission of fault.

Automated Replies as a Policy of Silence

Anyone who’s ever tried to contact Coinbase support knows the pattern: robotic, copy-paste replies that read more like error messages than customer care.

Automation might work for routine password resets or FAQs, but when it comes to blocked funds and completed verifications, these generic answers only deepen user frustration.

Instead of a simple “yes” or “no,” Coinbase repeats the same hollow phrases: “your case is under review,” “we appreciate your patience,” or “our security team is working on it.”

Behind those phrases is a growing perception that Coinbase’s automation isn’t efficiency — it’s avoidance. Each unanswered question erodes the trust that users once placed in the platform.

When Does Security Stop Being Security — and Start Being Control?

To be clear, security procedures are essential in any financial system.

But there’s a fine line between genuine protection and misuse of procedural power. When “security clearance” becomes an indefinite excuse to withhold verified funds, it stops serving users — and starts serving corporate interests.

Coinbase has built its global image on transparency, regulation, and compliance. Yet, this case — like many others circulating through Reddit, X, and crypto forums — reveals a deeper problem: a lack of direct accountability when things go wrong. Users are caught between two institutions, each pointing to the other, while their assets remain stuck in digital limbo.

A Warning to the Crypto Community

This isn’t just a story about one user or one transaction. It’s a reminder that even in 2025, centralized exchanges still hold the same power as traditional banks — with even less responsibility.

Coinbase can freeze funds, delay payments, and hide behind generic language — all without offering a clear explanation or a timeline.

Until exchanges like Coinbase start treating transparency as seriously as they treat compliance, trust in centralized crypto platforms will continue to fade.

And when that trust is gone, no amount of “security clearance” will restore it.

Call to Action: Demand Transparency

If you’ve experienced similar delays, contradictory answers, or unexplained “security reviews,” share your story.

Every user’s experience adds weight to the call for accountability.

Crypto was meant to empower individuals — not to trap them behind automated walls.

It’s time for Coinbase and other exchanges to be reminded that security without transparency isn’t protection — it’s control.